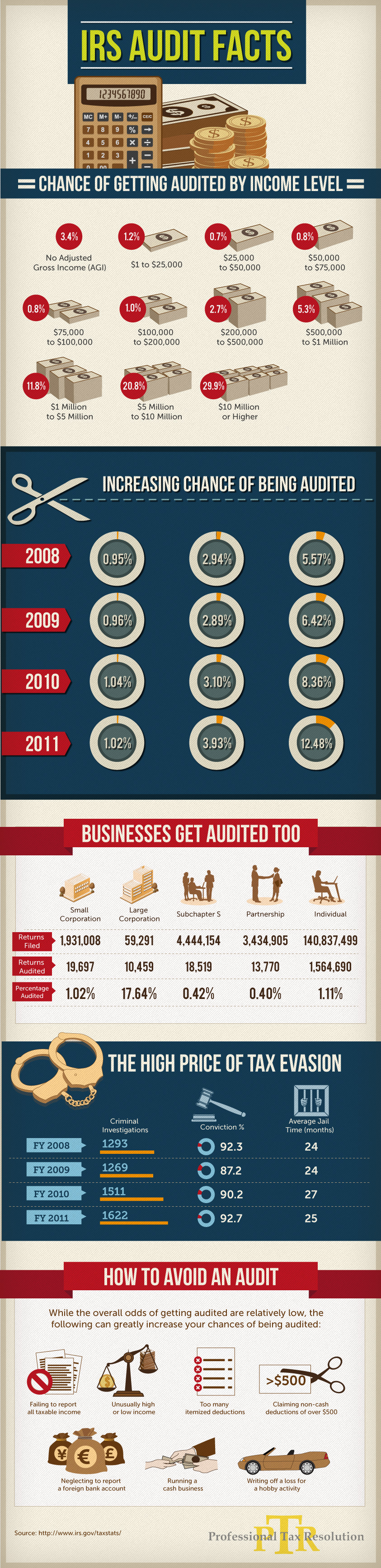

This infographic presents a visual story of how to avoid an IRS Audit. Over a million people just like you get audited each year. Are you at risk of an audit? Find out now.

Category Archives: IRS

IRS Tax Return System Is Not Able to Retire Yet….

The Internal Revenue Service is not ready to retire the legacy e-file system. The e-file system became operational nationwide in 1990 and transformed the way taxes were filed. The e-file has proven in its time to be win-win for everyone. The taxpayers get their refunds by as fast as 10 days. Or, they have payment options to file now and pay later. The e-file returns are also very accurate. They have an error rate of 1% compared to 20% for a paper return.

The next phase for the IRS filing system is the Modernized e-File (MeF) System. The MeF will send acknowledgments out in minutes opposed to 48 hours. The IRS had planned to replace the legacy e-file with the MeF after the 2012 filing season. However, there seems to be some reported problems with the MeF and they will need to be corrected before this new system can be implemented.

A first report of MeF found that the system has difficulty processing large volumes of tax returns for extended period of time. It is a concern that performance issues with the MeF may affect the systems reliability. The IRS does not want to develop a retirement plan for the legacy e-file until all the glitches in the MeF has been resolved.

“The Modernized e-File is a part of the initiative by the IRS to meet the needs of the taxpayers, reduce taxpayer burden, and broaden the use of electronic interaction.” Said Treasury Inspector General for Tax Administration, J. Russell George. “ However, due to problems we identified, it will be necessary to demonstrate the system’s ability to process all returns filed electronically for an entire season before the Legacy e-file system can be completely retired.”

If you have tax debt you are unable to pay or any other questions our tax settlement professionals are happy to discuss you’re tax resolutions free of charge. For more information about our services, visit us today at www.professionaltaxresolution.com. With over 16 years in the business of resolving tax debt, we have a thorough understanding of tax law together with the experience to know which settlement option will be the best fit for your specific set of circumstances.

For more information about our tax debt resolution services visit us at www.professionaltaxresolution.com. Contact us by phone at 877.889.6527 to receive a free, no obligation consultation.

IRS Installment Agreements

If you owe back taxes to the IRS an installment agreement is one of the most common methods used to make payments to the IRS. A monthly general plan is usually the simplest way to set up an arrangement to pay off any taxes owed to the Internal Revenue Service. Even if you are filing your taxes and you cannot pay the entire amount owed, you can send an installment agreement form with your tax return. IRS installment agreements are usually easy to obtain when the amount owed is $25,000 or less. That being said the IRS has four types of installment agreements. Below is a description of each one:

Guaranteed Installment Agreement: This is definitely the simplest installment agreement. It is for someone who owes $10,000 or less to the IRS. However, one must fit the following criteria:

- Have not filed late or paid late in the last five years.

- All of your taxes are filed.

- Your monthly installments will pay off your balance within 36 months.

- You will file and pay your taxes on time from now on.

The biggest advantage of this type of installment agreement is that the IRS will not file a federal tax lien.

Streamlined Installment Agreement: This type of plan is designed for individuals who owe $25,000 or less to the IRS and it must be paid off in 60 months or less.

However, effective on March 7th, 2012 taxpayers who owe $50,000 or less and can pay off the balance in 72 months or less are also included due to the expansion of the Fresh Start Initiative.

The biggest plus to the streamlined installment agreement is that a federal tax lien is not required. However, all your tax returns from must be filed, and you acknowledge to file your returns on time and as well pay your taxes on time in the future.

Partial Payment Agreement: This type of agreement works best when the guaranteed or streamlined installment agreements do not work for you. This is a type of payment arrangement that is based on what you can afford after a review of your living expenses. Unlike, the guaranteed or streamlined installment agreements, partial payment agreements can be set up to cover a longer repayment term. However, the IRS could file federal tax lien. Also, this type of agreement will need to be reevaluated every two years to see if you could pay more money. (https://store.spaceylon.com/)

“Non-Streamlined” Installment Agreements: If none of the above installment agreements work for you then you will need to negotiate your own installment agreement with the IRS. Usually this is the case if you owe $25,000 or more, if you need longer than 5 years to pay off the balance, or if you do not meet any of the criteria for a streamlined or guaranteed installment agreement.

This type of agreement is negotiated directly with the IRS agent and IRS manager. The IRS will most likely file a federal tax lien. You will also need to fill out a financial statement with additional financial information for the IRS to review.

If you have tax debt you are unable to pay or any other questions our tax settlement professionals are happy to discuss you’re tax resolutions free of charge. For more information about our services, visit us today at www.professionaltaxresolution.com. With over 16 years in the business of resolving tax debt, we have a thorough understanding of tax law together with the experience to know which settlement option will be the best fit for your specific set of circumstances.

For more information about our tax debt resolution services visit us at www.professionaltaxresolution.com. Contact us by phone at 877.889.6527 to receive a free, no obligation consultation.

IRS Commmissioner to Step Down

The Internal Revenue Service (IRS) Commissioner Doug Shulman has announced officially his plans to step down the end of this term. Mr. Shulman is the 47th commissioner to serve and he has been in office since March 24th, 2008 and plans to step down on November 9th, 2012. George W. Bush appointed Shulman to office. Commissioners generally serve one term and no commissioner has ever served longer than five years since the office was created by Congress by the Revenue act of 1862.

Shulman has held office during difficult times in this economy. According to Shulman, “The IRS team has made remarkable progress in the last few years during a challenging period. It has been an honor to serve the American people during this dynamic time.”

The IRS Commissioner is a role with many responsibilities and it includes the management of over 100,000 employees. The commissioners are nominated by the President and confirmed by the Senate. A new commissioner will not take his place until after the presidential and congressional elections. In the interim Deputy Commissioner for Services and Enforcement Steven T. Miller will serve as the acting IRS commissioner when Shulman steps down.

If you have any tax questions or tax debt you are unable to pay our tax settlement professionals are happy to discuss you’re tax resolutions free of charge. For more information about our services, visit us today at www.professionaltaxresolution.com. With over 16 years in the business of resolving tax debt, we have a thorough understanding of tax law together with the experience to know which settlement option will be the best fit for your specific set of circumstances.

For more information about our tax debt resolution services visit us at www.professionaltaxresolution.com. Contact us by phone at 877.889.6527.

New Healthcare Changes for Small Businesses – IRS

The Supreme Court recently settled a divided debate when it ruled that the Patient Protection and Affordable Care Act (PPACA) individual mandate is constitutional and that the “shared responsibility payment” is a tax. How will this affect you?

History

Beginning in 2014, the PPACA will require individuals to carry a minimum healthcare coverage for themselves and their dependents or they will have to pay a fee which is called a “shared responsibility payment.” Before the Supreme Court decision was made, the first definition stated the shared responsibility payment was a “penalty” for people who decided not to purchase health insurance under the required mandate. In this decision the Court decided that the mandate was constitutional because the payment was included in Congress’ immense power to tax. Therefore, the court decided that the required shared responsibility payment was indeed a tax.

How will this ruling affect you? If you have health insurance through a private provider or with Medicaid or Medicare, some unique groups, and individuals with low incomes will be exempt from the individual mandate. However, the Congressional Budget Office believes around 4 million U.S taxpayers will have to pay the mandate tax in 2014 when these provisions are executed. Most of these 4 million taxpayers are included in the 27 million small businesses in the United States. Due to the fact many small business owners are sometimes underinsured or uninsured. Therefore they will be a likely group that will be subject to the shared responsibility payment.

It seems that these added taxes could be quite substantial. The household income and family size will affect how much the taxpayer will owe. For example, when the mandate provision is fully implemented in 2016, the additional tax liability could be 2.5% of the family income or $695 for each uninsured adult, whichever is more, up to $12,500.

More on the Mandate Tax

Per the Supreme Court’s decision the shared responsibility payment will be a tax. Originally, the legislation labeled the individual mandate as a penalty. However, the Supreme Court did not want it to punishable by nature. However, one thing is certain: The IRS has the authority to assess and collect the tax.

It is still unknown how the IRS will administer the mandate tax. Usually the IRS sends notices to the taxpayers with unpaid balances. Then if the taxpayer does not pay the balance, the IRS transfers the account to collections, where they then can file liens and levies of wages, income, and certain financial accounts. However, it does seem the PPACA has given the IRS restricted authority on how it will collect the mandate tax. Right now, under the current legislation, the IRS cannot send unpaid mandate tax balances to collection for enforcement, or can it issue liens or levies. The IRS will give out notices and offset refunds in order to collect the tax.

If you have tax debt you are unable to pay or any other questions our tax settlement professionals are happy to discuss you’re tax resolutions free of charge. For more information about our services, visit us today at www.professionalresolution.com. With over 16 years in the business of resolving tax debt, we have a thorough understanding of tax law together with the experience to know which settlement option will be the best fit for your specific set of circumstances.

For more information about our tax debt resolution services visit us at www.professionaltaxresolution.com. Contact us by phone at 877.889.6527 to receive a free, no obligation consultation.