Audit Reconsideration Eliminates $100,000 Tax Balance

When Ms. H contacted our office, she was panicked over how to pay a back tax balance of $101,000. She had recently received an official IRS Letter informing her of a balance due and threatening enforcement action since she had not responded to previous notices. This was followed almost immediately by a Notice of Intent to Audit. It turns out that Ms. H had sold her personal residence in a previous tax year and had forgotten to report the sale of the home on her tax return. Although the IRS had sent various letters informing her of the discrepancy and assessing a tax balance due, she had not received them due to the fact that she had been moving around.

Our office quickly began working on the client’s back tax issues. We filed Powers of Attorney with the IRS and the California Franchise Tax Board and followed up by contacting both tax agencies to ensure that the client’s accounts would not be subjected to any collection activity while our tax professionals the prepared an audit reconsideration packet. Within a few days, we had submitted a complete audit reconsideration request to the IRS and had stopped the CA FTB from assessing Ms. H’s accounts. The final ruling from the IRS was very favorable. Not only did our client not owe a back tax balance, but she received a refund of $8,000 from funds the IRS had withheld from previous tax years!

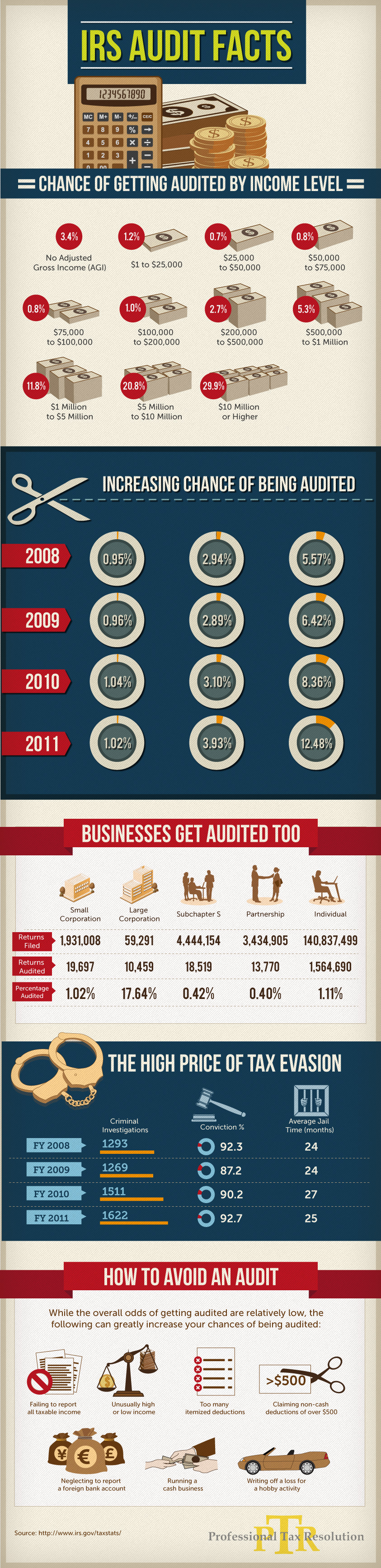

The tax settlement case of Ms. H illustrates several important points. First and foremost, it shows that a reputable tax settlement firm offers a huge advantage to clients who are trying to resolve on outstanding tax balance. Not only do these professionals know exactly what problems to look for when analyzing a client’s finances, but they have the experience necessary to successfully resolve those problems with the IRS and State Tax Agencies. In addition, this case shows that receiving a Notice of Intent to Audit does not necessarily mean that the recipient will owe a large tax amount. In addition to plain old random sampling, a tax return may be selected for audit for a variety of reasons including a filing error or missing tax information. Such was the case with Ms. H whose return was targeted for closer scrutiny due to her failure to report the proceeds from the sale of a home. Once the error is corrected and an accurate tax situation is presented for examination, the audit may actually result in a reduced tax balance or even a refund as happened in the situation described above.

If you have tax questions or a tax debt you are unable to pay, our tax settlement professionals are happy to discuss your tax resolution options free of charge. For more information about our services, visit us today at www.professionaltaxresolution.com or call us at 877.889.6527. With over 16 years in the business of resolving tax debt, we have a thorough understanding of tax law together with the experience to know which settlement option will be the best fit for your specific set of circumstances.