Tax Deadline for Citizens Living Abroad – The tax filing deadline for United States citizens living abroad is on the horizon. That deadline is June 15th (pushed to June 16th for 2014). This automatic two month tax extension is granted to all overseas residents and does not require an extension request. The only condition for claiming the extension is for the taxpayer to attach a written statement when the return is submitted stating that both the primary residence and main place of business are outside of the country.

If a taxpayer residing abroad is unable to file a tax return within the automatic two month extension period, they must then file a written request to gain an additional four month extension. Although neither a late filing penalty nor a late payment penalty will be assessed on any returns covered by these extension periods, interest will normally accrue on any tax amount owed. As is true for taxpayers residing within the United States, all tax returns for United States citizens residing outside the county must be filed by the October 15th tax extension deadline.

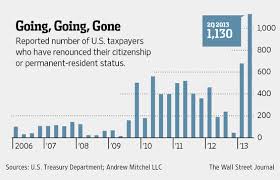

The United States is one of a few countries that requires its citizens living abroad to pay income taxes. This filing requirement applies to any United States citizen who earns more than $10,000 ($20,000 for a joint return) in any given year. Although rule applies even when some or all of the income is earned outside the country, certain income earned from foreign sources is exempt from taxation. In addition, taxpayers can sometimes claim a tax credit on their United States tax return for taxes paid outside of the county.

On top of filing an income tax return, United States citizens residing abroad are required to submit an FBAR Report if they hold foreign assets in excess of $10,000. Although the deadline for submitting the FBAR Report to the United States Department of Treasury is June 30th, some of the information contained in the report is required for the tax return due two weeks earlier. Ownership in foreign businesses and holdings of other foreign assets must be itemized on the FBAR Report while Income from these same sources is required for the income tax return.

If you are a United States citizen residing abroad, our tax settlement professionals can help you evaluate and meet your tax filing requirements. The CPAs and Enrolled Agents at Professional Tax Resolution are experts in the area of foreign tax compliance and can help you evaluate your foreign income reporting requirements. Our experienced tax settlement professionals offer a free, no obligation consultation to answer any tax question or to discuss tax resolution optionsfor a tax debt you are unable to pay. For more information about out full range of tax services, call us at 877.889.6527 or visit our website at www.professionaltaxresolution.com.