The Tax Debt Debate – One interesting provision of the Tax Extenders Bill that is currently stalled in the United States Senate is the privatization of tax debt collection activities. The Tax Extenders Bill, which is unlikely to be voted on again this month, contains a clause that suggests turning delinquent tax accounts over to private collection agencies. This idea, which has actually been tried before, is the subject of much debate. While proponents believe that private companies specializing in debt collection will be better equipped to collect outstanding tax liabilities, opponents believe that their tactics may be unfair, especially to those taxpayers who are unable to pay their tax debt.

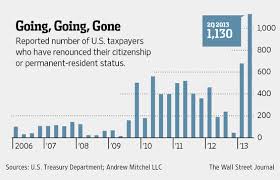

The tax gap, which is the difference between the dollar amount of taxes owed to the IRS and the amount they actually collect, has always been there. In fact, the data shows that it has remained fairly constant over recent years when measured according to the taxpayer compliance rate. Two years ago, the IRS released data comparing the 2006 tax gap to that of 2001. Although the gross tax gap increased over the five year period, from $345 billion to $450 billion, most of that amount was due to an increase in total tax liabilities. The compliance rate remained fairly constant at about 83%. Amounts collected following enforced collection activities by the IRS increased that rate to approximately 86% for both years. The IRS report noted that the compliance rate was highest where there was third party reporting or withholding. As expected, the percentage was much lower in areas such as retail business income where there is little or no information reporting.

In spite of the fact that total dollar amount of the tax gap is significant, many believe that turning the collection of tax debt over to private collection agencies is not the answer. After analyzing tax debt collection activities by the IRS for 2013, National Taxpayer Advocate Nina Olsen released a statement saying that 79% of the delinquent taxes were owed by taxpayers with incomes below the poverty line. Ms. Olsen maintains that these tax debts are not collectible by any method. She further asserts that turning them over to private collections agencies might jeopardize taxpayer rights and still not achieve the intended result of increasing tax revenue. IRS Commissioner John Koskinen is also opposed to the privatized collection of tax debt but cites a different reason. He points out that the last time this method was tried, it did not accomplish its objective. While $98 billion in back taxes was collected by private agencies, it cost more than that amount to administer the collection program and pay the agencies for their efforts!

If you have an outstanding tax liability, contact out tax settlement professionals today to discuss your tax debt resolution options. For more information about our tax settlement services, visit us today at www.professionaltaxresolution.com or call us at 877.889.6527 for a free consultation. We resolve tax problems all day, every day and have helped many satisfied clients successfully resolve their tax debt issues.