Although the requirement for filing an annual Report of Foreign Bank and Financial Accounts (FBAR) has technically been on the books since 1970, the compliance rate was less that 20% until 2001. Since that time, the United States government has stepped up its efforts to identify and punish those individuals who are guilty of concealing foreign assets and income as well as the foreign banks who have participated in the cover up.

Beginning in 2008, the IRS and the United States Department of Justice stepped up their game in the area of offshore tax evasion. In June of that year, the IRS issued a statement reminding taxpayers of their reporting obligations and the consequences of not meeting them. John DiCicco of the Justice Department’s Tax Division issued a similar statement saying that they would “work hand-in-hand with the IRS to vigorously enforce the tax laws against those taxpayers who use offshore accounts to evade taxes.” Following that, the United States Department of Justice began actively prosecuting criminal cases related to foreign bank accounts.

The actions of 2008 produced some immediate results. Before the end of the year, Bradley Birkenfeld, a UBS banker who was charged with helping United States taxpayers evade income taxes by ignoring FBAR reporting requirements, had entered a guilty plea. Birkenfeld disclosed that UBS was managing assets of over $20 billing for United States citizens trying to avoid taxes. Shortly thereafter, the IRS was granted the authority to request information from UBS about those individuals. This was the beginning of the end of the flagrant use of foreign banks to hide assets for the purpose of avoiding taxes. Since that time:

- Over $5.5 billion in back taxes and penalties has been collected from taxpayers trying to avoid prosecution.

- More than 38,000 taxpayers have joined the government’s amnesty program.

- Fourteen Swiss banks have been placed under investigation.

- A total of 103 taxpayers have been prosecuted with 62 guilty pleas and five trial convictions.

- Of those prosecuted, 49 have been sentenced with most of those receiving either probation or home confinement. Only 18 of those sentenced have received prison time with only two receiving a sentence of longer than a year and a day.

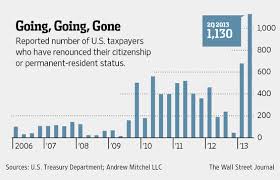

We are currently in a holding pattern, awaiting the official enforcement of the Foreign Account Tax Compliance Act (FATCA). This legislation, passed in March of 2010, requires individuals who have more than $50,000 in foreign assets to report those asserts on Form 8038 while, at the same time, requiring foreign banks to disclose information about account holders who are United States citizens. Although the enforcement of FATCA has been postponed until July, 2014, recent headlines announcing the prosecution of some fairly prominent individuals have resulted in the majority of taxpayers being acutely aware of the consequences of offshore tax evasion.

The CPAs, Enrolled Agents and Tax Attorneys at Professional Tax Resolution are up to date on the current requirements for FATCA compliance and have extensive experience in the area of FBAR reporting. Contact us today if you are concerned about whether you meet the current reporting requirements for foreign assets and income. For more information about our services, visit us today at www.professionaltaxresolution.com or call us at 877.889.6527 to receive a free, no obligation consultation.